Portfolio Roles

November 5, 2023

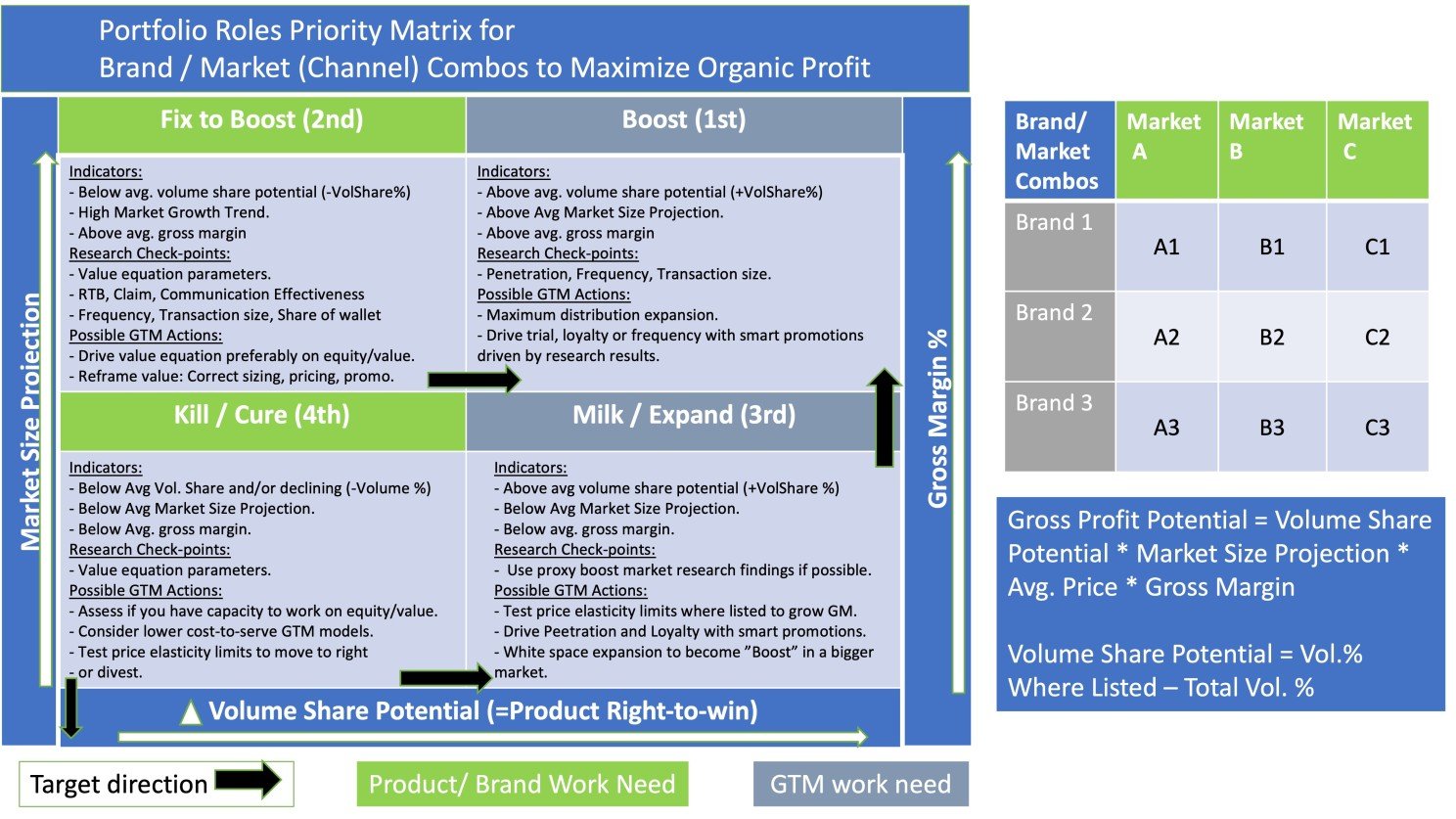

A portfolio means you are lucky enough to have multiple players in one segment of business. This may be a portfolio of brands in the same category. This may be a portfolio of countries in the same cluster. This may be a portfolio of flankers or SKUs under the same brand etc. The way I will write the article will be more for products in a category, but the principles apply to all kinds of portfolio management.

Every element of the portfolio needs to have a role to play or cease to exist. Every element of portfolio represents a cost of existence and a complexity to manage. There will be multi-functional people capacity allocated to it all along its lifecycle within the company. There will be manufacturing capacity allocated for it. There will be marketing and sales capacity allocated. There will be warehousing, logistics capacity allocated etc. The net revenue of each element needs to stay accretive to the total portfolio so that it deserves to be invested behind out of an always limited capacity. I know mathematically this is not possible as each time you cut the tail there will be a new tail of the rest, but I believe you get what I mean :).

Let’s talk about the possible players and their roles and what that means in terms of the activity system in operations and organizational design.

Conquerors (Role: Boost Growth):

These are the guys who has it all. They have customer right-to-win with proven and demonstrable superior performance endorsed by its users, they have a big enough gross margin to re-invest into product innovation, they have a huge growth potential given the underserved customers with the same need, they have the market value-fit with the right sizing, pricing and thus they are growing their market share everywhere they are distributed. These are the guys you need to put most of your resources and investment behind to boost your growth. These are the guys you need to drive the distribution and superiority communication behind. These are the guys you need to shout in all the touch points of your marketing funnel both to drive awareness and loyalty. These are the guys you can manage the maximum amount of complexity and cost in terms of organizational and operational design.

Winners (Role: Drive Growth):

These are the guys who has to some extent the customer right-to-win, relatively big growth potential and healthy financials ie. gross margin to re-invest into R&D and innovation but missing some other elements of a conqueror. They are also growing their market share but not everywhere they are distributed. So, it means they have some work to do to move to being conquerors. These guys can get half of what is left from the conquerors in terms of capacity and focus. They might need some product innovation to sharpen their performance vs competition and thus customer right-to-win. They might need some market fit work to adjust their sizing and pricing where they are distributed. They might need better and more targeted communication of their superiority in different touch points of the marketing funnel. Their target is to move to being conquerors so that you have a bigger part of your portfolio to boost the growth.

Financiers (Role: Finance the growth):

These are the guys with a relatively strong customer right-to-win with high gross margin but limited growth potential due to market size, your existing high market share and or capacity. They might be addressing a niche market with low competition. The market, share and volume growth might be mostly flat. You may try to test the pricing elasticity to its limits for a limited growth of course but this would not be sustainable. That does not mean that you can risk losing a business like this. You need to put the needed amount of capacity and resources to maintain this part of portfolio to be able to re-invest some of the dividends to your growth drivers. I do not particularly like the term, but this is what “milking” refers to in business terminology.

Defenders (Role: Stop the competition):

These are the guys who does not have a clear-cut customer right-to-win, but they are good enough to keep some profitable market share in a category and stop the competition to grow further. They might be a lower priced and thus lower margin alternative in a category where no one has a clear-cut superiority. They might play a tactical role to occupy valuable space in shelving or merchandising stopping the competition becoming more visible at POS. They are the first line of defense to give you time to come up with conquerors and winners into the category. They are needed but would get the least amount of capacity and focus left from the above players.

Substitutes (Role: Perform or die):

These are the guys which currently have no role to play in a portfolio. Meaning they have neither a right-to-win nor enough share or growth potential or margin to justify their existence. They are draining your limited capacity and dragging down your financial results as a business. They needed to be cured or killed for the benefit of the rest of the business. You do not make these kinds of decisions with impulse of course. There would be a probation period where you first try to cure before you kill. You first try to make it fit to a role with tweaks. This tweak may come from a tactical commercial innovation, it may be coming from pricing or smart cost elimination. The only resource or capacity that you should allocate to a player like this is once a year exercise to define them and decide an action plan to cure them with a deadline and/or kill them if it does not work.

As per the format of these articles let me tell you about a real-life experience I had in this area.

I was the regional commercial director of the company managing 17 country, 27 full-service distributors. We were managing a very complex product portfolio of 800 category country combination with more than 5000 SKUs with 30 People in the HQ. Everybody in the team was exhausted and unhappy with the workload and work life balance. There were multiple cases of absence of leave due to burnout of employees.

This was THE business to make clear choices. We would have to make all possible simplification and standardization effort to be able to manage this business and drive growth.

We decided to make a strategy off-site meeting having all the data needed with us and come out of that meeting with a portfolio strategy and cascading organizational and operational choices. We sorted all brands, SKUs, and countries as per their net operating margin, sales, and market share progression. We also clustered our markets as per the consumer related similarities like language and affluence. In the end we had our quadrants like above definitions with country/ category/ brand names in it to allocate our resources accordingly in terms of people and spending and 500 SKUs in the cure or kill exercise which were eventually killed as there was no cure possible. We also defined 3 clusters with lead markets defined for each cluster to make the full-fledge marketing and sales content work centrally and share the content with the rest of the countries to reapply them with their own resources. So we put most of our work behind conquerors and winners in 3 cluster lead market vs trying to make everything everywhere centrally and instead decided to develop distributor capability to make the rest of it. As a result after 5 years of transition both the business and organizational survey results were stellar and everybody was happy.

Lesson Learned: You can maximize growth with a differentiated focus on a portfolio mix.

Hope you enjoyed it.

See you soon on the next article,

Firat